|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Place to Refinance Your Home: Exploring Top OptionsRefinancing your home can be a strategic move to lower your interest rates, reduce monthly payments, or switch loan types. However, the challenge lies in finding the best place to refinance your home. In this guide, we will explore various options and factors to consider. Understanding Home RefinancingWhat is Refinancing?Refinancing involves replacing your existing mortgage with a new one, often with better terms. This can be beneficial if interest rates have dropped since you took out your original loan. Benefits of Refinancing

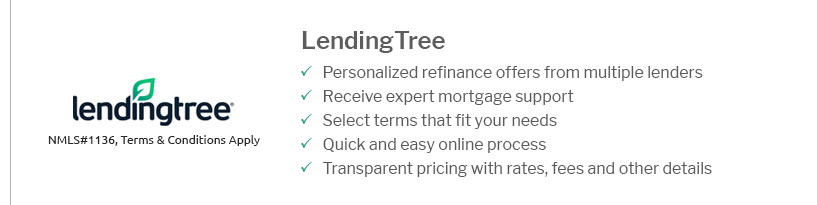

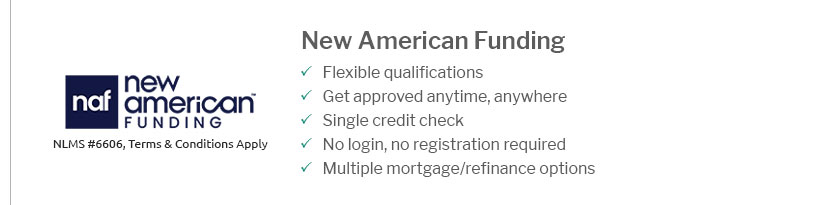

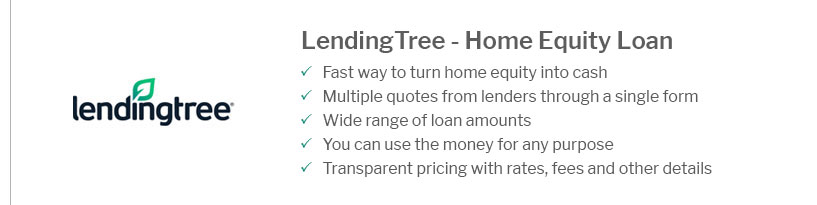

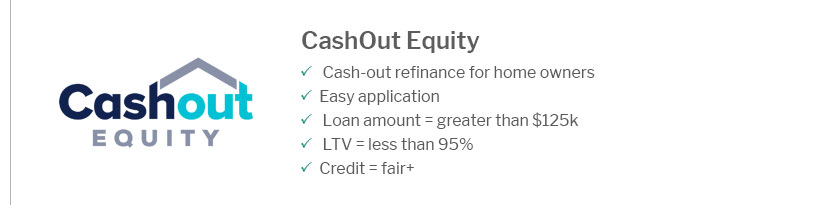

Top Places to Refinance Your HomeBanks and Credit UnionsBanks and credit unions offer competitive rates, especially for existing customers. They can provide a sense of security and reliability. Online LendersOnline lenders often provide lower rates and fees due to reduced overhead costs. They offer a convenient application process, making them a popular choice. Mortgage BrokersMortgage brokers can compare various lenders on your behalf to find the best deal. They have access to multiple loan products, offering flexibility in options. For those looking for no cost refinance options, it's essential to understand the trade-offs involved, such as potentially higher interest rates. Factors to ConsiderCurrent Interest RatesInterest rates play a crucial role in refinancing decisions. Comparing rates from multiple sources can help you secure the best deal. For example, checking oregon refinance interest rates can provide insight into regional variations. Fees and Closing CostsBe mindful of associated fees and closing costs, as they can offset savings from lower interest rates. Always ask for a detailed cost breakdown. FAQs

In conclusion, finding the best place to refinance your home involves understanding your financial goals, comparing rates and fees, and choosing a lender that fits your needs. Whether you opt for a traditional bank, an online lender, or a mortgage broker, each has its unique advantages to consider. https://www.investopedia.com/mortgage/refinance/

When shopping around for a new mortgage, remember to look at interest rates and closing costs, good faith estimates, and the breakeven point. Consider using the ... https://www.va.gov/housing-assistance/home-loans/loan-types/cash-out-loan/

You'll go through a private bank, mortgage company, or credit unionnot directly through usto get a cash-out refinance loan. Terms and fees may ... https://www.nerdwallet.com/best/mortgages/cash-out-refinance-lenders

Why We Like ItPNC Bank has a variety of appealing mortgage options, including jumbo refinance loans. It's simple to browse rates and apply ...

|

|---|